Company: Siemens

Business: A German electrical engineering company. They are divided into four sectors: Energy (generate, transmit and distribute electrical power at the highest levels of efficiency), Healthcare (medicinal equipment, analytical equipment etc.), Industry (automation technology, industrial control and drive technology as well as industrial software) and finally Infrastructure & Cities (integrated mobility solutions, building and security systems, power distribution equipment and smart grid applications).

Active: World wide with activities in over 190 countries.

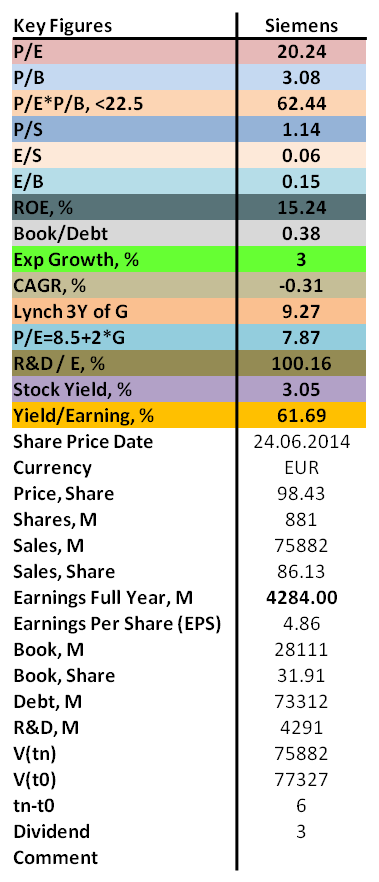

P/E: 20.2

Here you can find the previous analysis of Siemens.

The P/E is twice as high as what I like with 20.2 and the P/B is around the same level with 3.1 which means that Graham would not be a fan of Siemens for making an investment. Their earnings to sales are at 6% which I find to be ok and the ROE is at 15% which is also acceptable. The book to debt ratio I find far too low with 0.4. In the last six years they have had a yearly growth rate of -0.3% which is awful and this then gives us a motivated P/E around 8 to 10 which means they are being traded today on the market at an overvalued share price. They spend a lot of money on research and so much that it corresponds to 100% of their earnings which by the sound of it is very (too?) high. They pay a fully acceptable dividend of 3.1% which however represents almost 62% of their earnings so they are paying out a high ratio which means risk of decreasing or remaining dividends unless the earnings are improved. In the last three years the dividend has been fixed at 3 € per share.

Conclusion: Both Graham and I say no to this one. It is a great company and one day when it gets cheap I will try to step in as shareholder but 2014 does not seem to be the year for that. The P/E and P/B is simply too high for being of interest.

If this analysis is outdated then you can request a new one.

No comments:

Post a Comment