My Russian car company Avtovaz have arrived with their full year report and the reading was not pretty... not pretty at all.

For the report in full please go here and to read my previous summary please click on Avtovaz report Q3 2015 and to find out more regarding Avtovaz then please visit Analysis of Avtovaz (a new one will arrive shortly though).

As I mentioned in my previous report the costs started to run out of hand and on top of things Mr. Andersson decided to take large impairment costs which was a bit spread out over the year but the large bulk of it came in the fourth quarter. Avtovaz now have a large negative equity and for the shares that are traded around 10 RUB they need to bring in around 18 RUB to make sure not to have negative equity any more. That is really though. I would be surprised if they ask for the full amount but they will have to issue a lot of new shares and I am scared to hear at which price that will be.

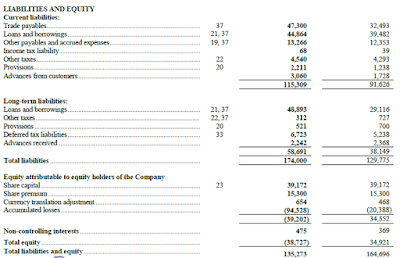

This time I would therefore like to starts with the balance sheet as can be seen below. The liabilities have grown by 34% which is a disturbing speed but the worst is the accumulated losses as can be seen in the equity part. It is now up at 94 billion RUB which is an 370% increase compared to last year. Wooow! Avtovaz really need to improve its balance sheet and the only way will be to issue more shares. Mr. Andersson mentioned this and he expected the shareholders to comply. Is there an option?

Looking at the financial statement we see that things are not running smoothly and I previously also mentioned that Mr. Andersson seems to do everything in his power to take market shares because during Q4 and the full year we see no improvements on the trend that we saw also in Q3... actually it has become even worse and the cost of sales compared to the sales have gone even one step further in the wrong direction. The very nice impairment cost of almost 43 billion RUB is excellent which then leads us as shareholders up to the yearly loss of round about 75 billion RUB. Oh, and it was 16 billion RUB in Q3 just to make it crystal clear how much fun Mr. Andersson have been having during this final quarter.

Interestingly though was that the Russian car market have decreased by -36% during 2015 and the revenue for Avtovaz only decreased by 8% but... this comes from price dumping and expecting to live on the shareholders.

Conclusion: The concern I had regarding issuing of new shares is no longer a concern but reality. It must be done and I would even claim that Mr. Andersson have deliberately created this situation. Now we will just have to see if every shareholder will be allowed to join in or if it will become selected to allow either the state of Russia, Renault or Nissan to increase their ownership. I would not be chocked if Russia will step in heavier. I will remain as a grumpy shareholder and once the issuing of new shares arrive I need to take a very close look at that before deciding what to do.

No comments:

Post a Comment